You’re reading CX Stories, a newsletter about customer experience innovation. If you want to join the 6000+ lovely people who receive it every month, just click the button below.

A good friend of mine, Tom Johnson, writes an excellent Substack full of boring charts. It’s called ‘Slow Futures’, with his point being that whilst lots changes, most things stay the same.

I thought of Tom recently when looking through the latest report from the UK’s Institute of Customer Services (ICS), a ‘national barometer of customer satisfaction’, as they describe it.

Here’s the three things I found most interesting from the July report (along with some watch outs about how data is presented) – and they’re three things that have always been true.

- Expectations vs Reality

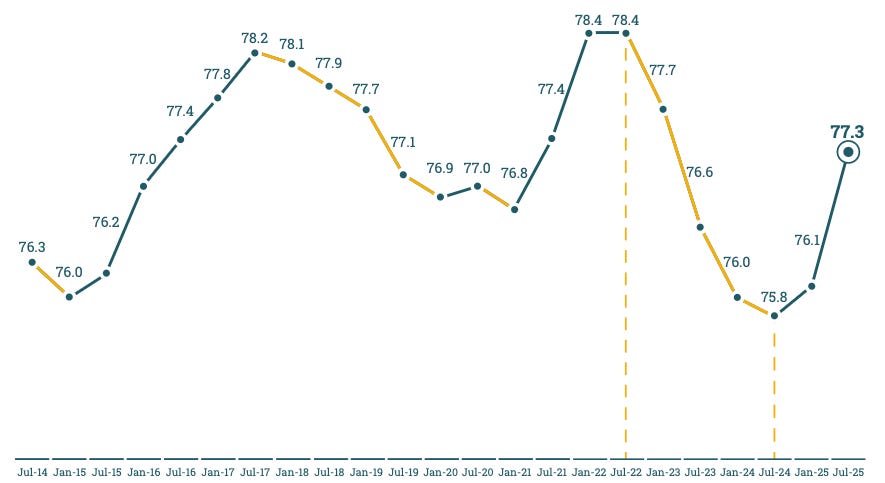

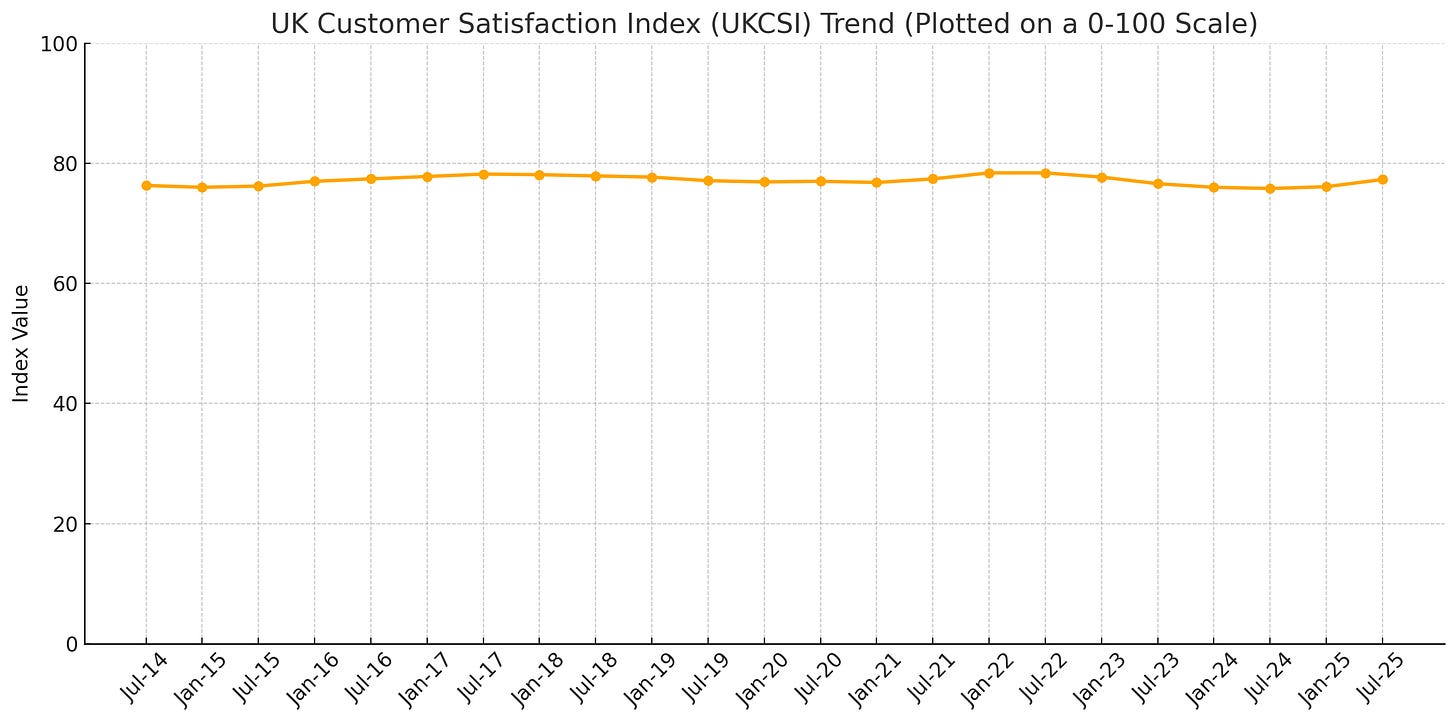

When you look at the ICS report, the headline satisfaction graph suggests a tumultuous decade of ups and downs. And as the foreword of the report says: ‘After 3 years of decline or stagnation, customer satisfaction in the UK has improved and the improvement is seen in almost all sectors.’

But channeling Tom, when you look at the same data on a wider axis, it looks, well, pretty boring really.

Just think about all the incredible changes we’ve had to customer experience in the past decade.

Want a taxi, or some food, or pretty much anything? One click, and it’s on the way. Fed up with a big, bulging wallet? Let’s get rid of tickets and credit cards and put them all in your phone. Want to spend, save, invest, send money anywhere in the world? You can do that, without leaving your kitchen.

But yet, we’re no happier than we were.

This isn’t a measure of things getter better or worse. This is a measure of how things compare to our expectations. And in that regard, the level of experience we get versus what we think we should get, is exactly the same as it was in 2014. And it will be in 2034: we’re always about 75% satisfied with what we get versus what we’re promised.

2. The drivers of customer decisions aren’t always what they seem

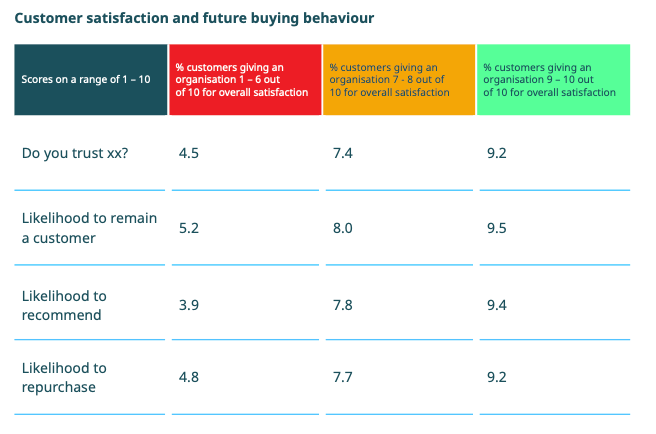

First, the good news for those of us who believe in the financial returns of customer experience; customers clearly report a correlation between customer satisfaction and their future buying decisions:

It’s easy to think that this is just about the service customers receive, but it’s important to remember customer decisions are influenced by a whole load of factors – including, often, perception over reality.

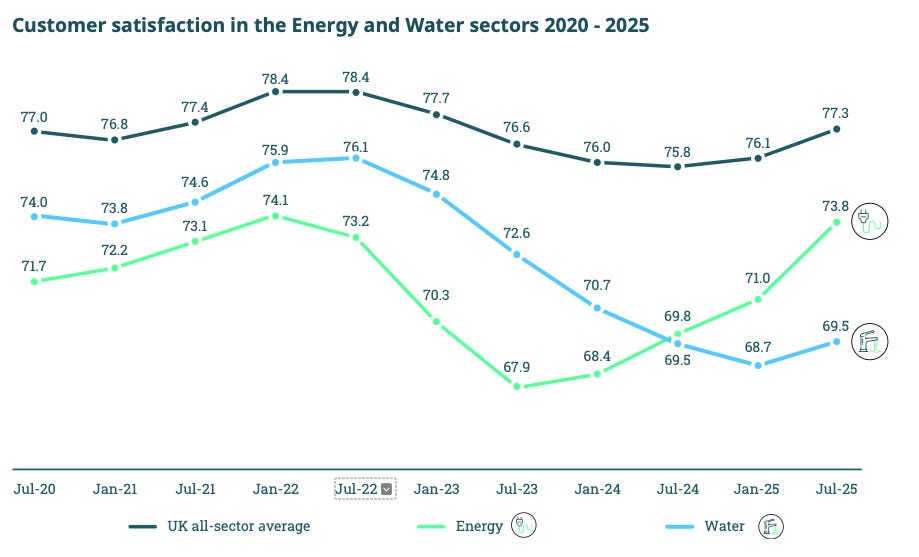

For example, here’s the reported satisfaction for energy companies in the past year:

Has the service provided by energy companies really dramatically improved in that time? Possibly, possibly not. Has inflation come down, and therefore the issue and industry disappeared from the headlines? Absolutely yes.

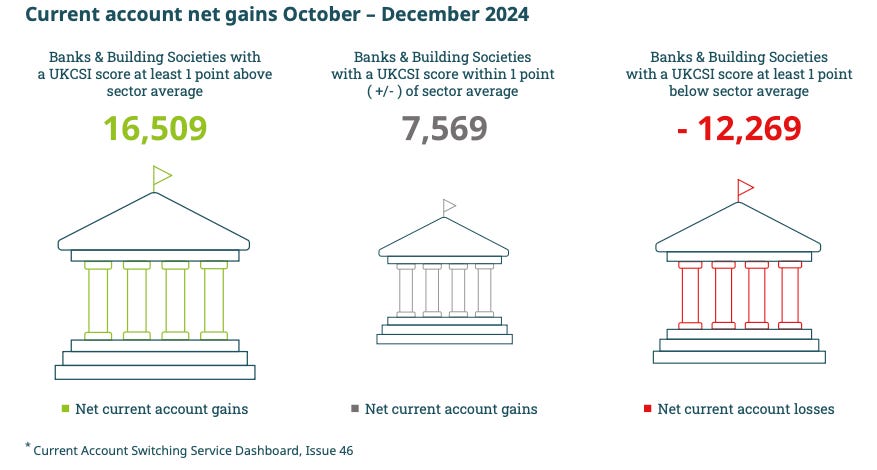

Similarly, the picture for banks giving a good experience looks rosy, with the report showing that those banks with higher UKCSI scores getting more customers switching to them:

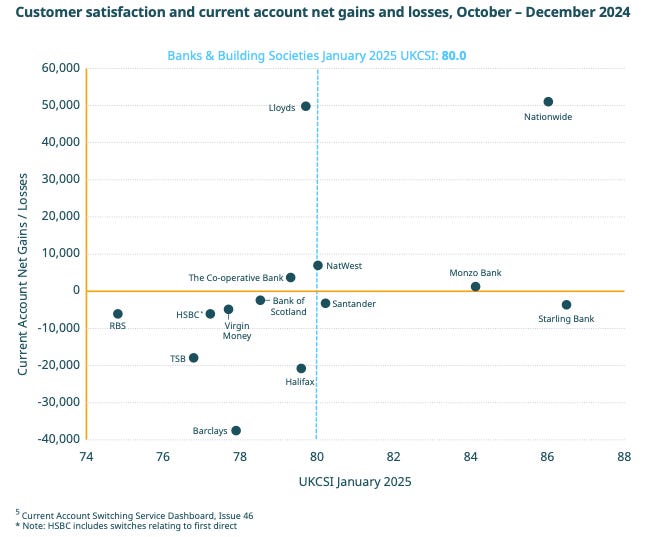

But on closer inspection, that word ‘average’ is doing a lot of heavy lifting there, with Nationwide’s performance really dragging it up:

And even then, has the service being delivered solely driven those customer decisions, or could something else be at play? As the ICS says in its own report:

Nationwide’s 51,254 net switching gains in the last 3 months of 2024 was more than any other bank or building society. The acquisition of customers was boosted by £175 cash incentive.

Lloyds Bank offered a £200 switching incentive to new customers who switched to a Club Lloyds account between October and December 2024 .

This decline may have been influenced by Starling Bank receiving a £29m fine from the FCA because of insufficient controls against financial crime, as well as Starling’s decision to remove 3.25% interest on current account balances

Customers will have reasons to avoid an organisation, to choose an organisation, and to stay with an organisation – and those decisions may not always be as straightforward as they seem, or what we want them to be.

- People see people as a source of certainty

For a long time, futurologists have talked about ‘The Human Premium’ – that people will be willing to pay more for human service. With the advent of actually-useful AI, it looks like that theory is about to be put to the test. But for now at least, real people firmly have their place in creating certainty for customers.

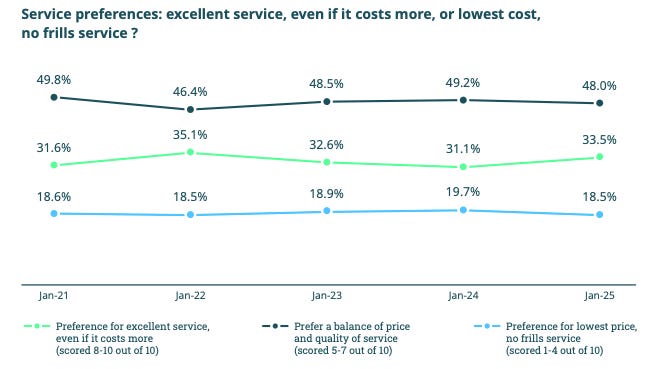

A third of people say they are willing to pay more to receive excellent service:

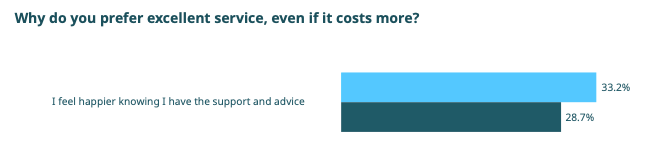

And when asked why, the top reason is the same as it always was – people are in search of certainty, wanting to know that they’ll be easy to contact, that someone is there to help if needed, that they’re making the right decision:

This really matters, because getting support – and being there when things go wrong – remains the area which in which customers are least satisfied at the moment. Even though there’s been a slight improvement, it’s still 6.6 points down on the 2022 performing:

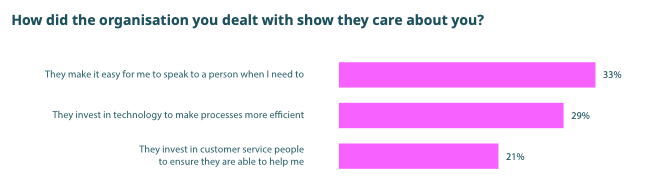

And when organisations are asked to put things right, how do they do it? Well, according to customers, the number one way that organisations show they care is by making it easy to speak to someone when they need to, with a combination of technology and humans seen as the perfect combination.

So there you have it.

Organisations are always promising a little more than they deliver. Earning customer decisions requires understanding all the things that matter to them. And if things go wrong, you have to put them right, with people willing to pay more for the certainty.

New news? I’m not so sure. But when the temptation is always to look to the future, sometimes it’s good to take a look to the past, and remember the things that will always be true.

Thanks for reading this article, I really hope you enjoyed it. You can subscribe to my monthly newsletter below, find me in picture form on Instagram @johnjsills, or in work mode at The Foundation and LinkedIn.